Our projects offer the opportunity to invest with mortgage security on a loan to equity ratio of 1:2, returning 10% per annum for a fixed term of 1 to 5 years.

Working Together

- Monopoly Property Group (MPG) specialises in establishing special purpose investment vehicles for international investors.

- MPG has a proven track record of success with high net worth international investors (references available upon request).

- Minimum cash investment AUD 2,000,000.00

Investment Vehicle

- MPG establishes a new investment vehicle to carry out each Project so that individual investors can be certain the investment vehicle has no prior history or undisclosed liabilities.

- The investment vehicle is usually a Fixed Unit Trust with a newly incorporated company as the trustee.

- The company trustee is entitled to the profits of each Project.

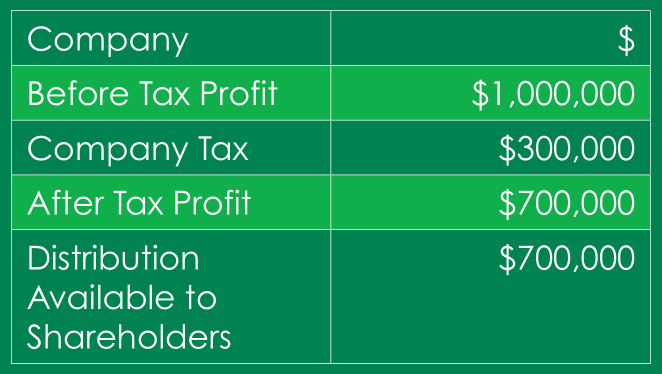

Why a Unit Trust?

- Unlike a Company, a Unit Trust pays no Australian tax on its profits.

- All profits made by the Unit Trust flow directly to the Unitholder in proportion to their Unitholding.

- All Unitholders pay tax based on their personal tax position.

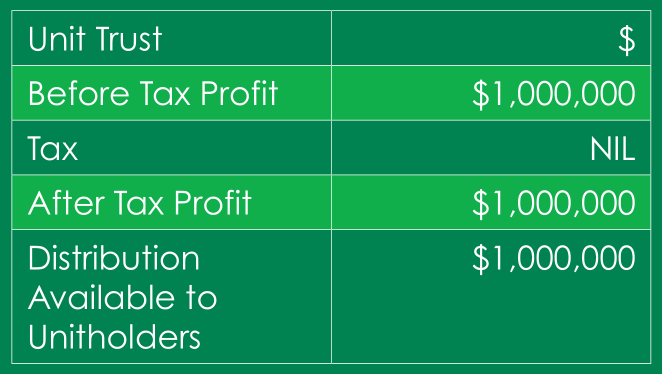

Unit Trust Structure

- A Unit Trust Deed appoints a new company as trustee to do the Project, and a Unitholder’s Deed (similar to a Shareholder’s agreement) is signed by all Unitholders.

- No changes can be made without the agreement of all Unitholders – each Unitholder’s percentage is fixed and cannot change without the agreement of all Unitholders.

- The Unit Trust is serviced by the company trustee with Unitholders having shares in the same proportion as their Unitholdings.

- Each Unitholder has a right to appoint and remove a Director to the company trustee.

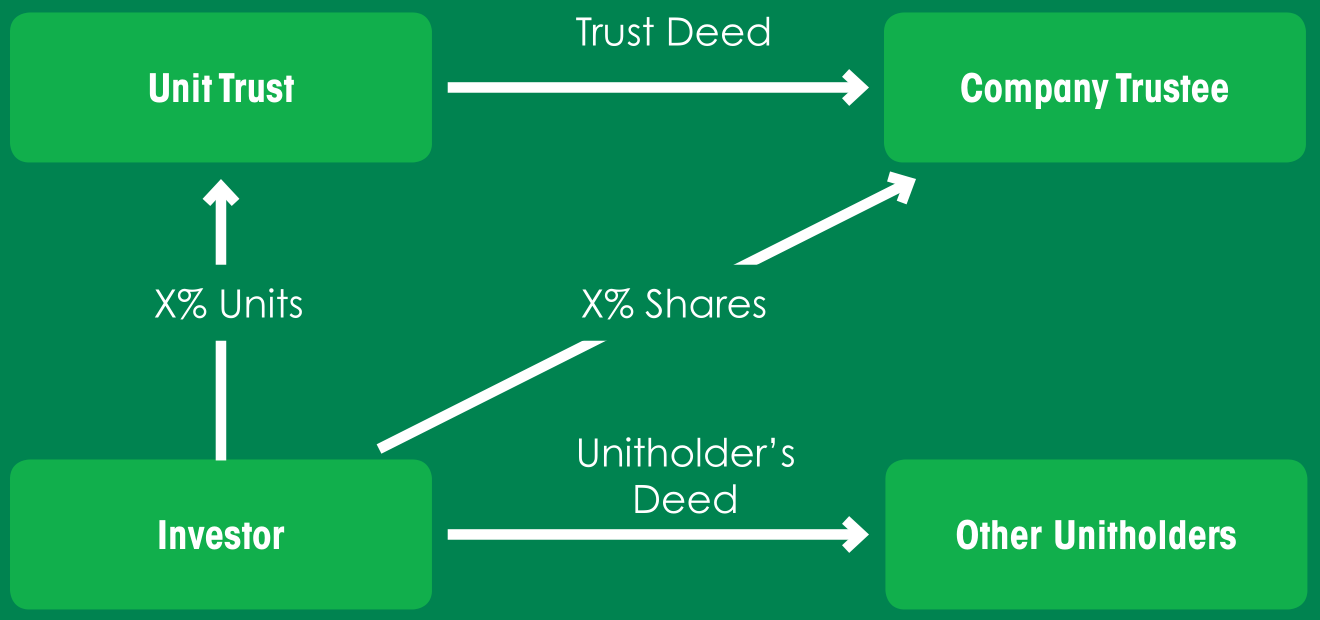

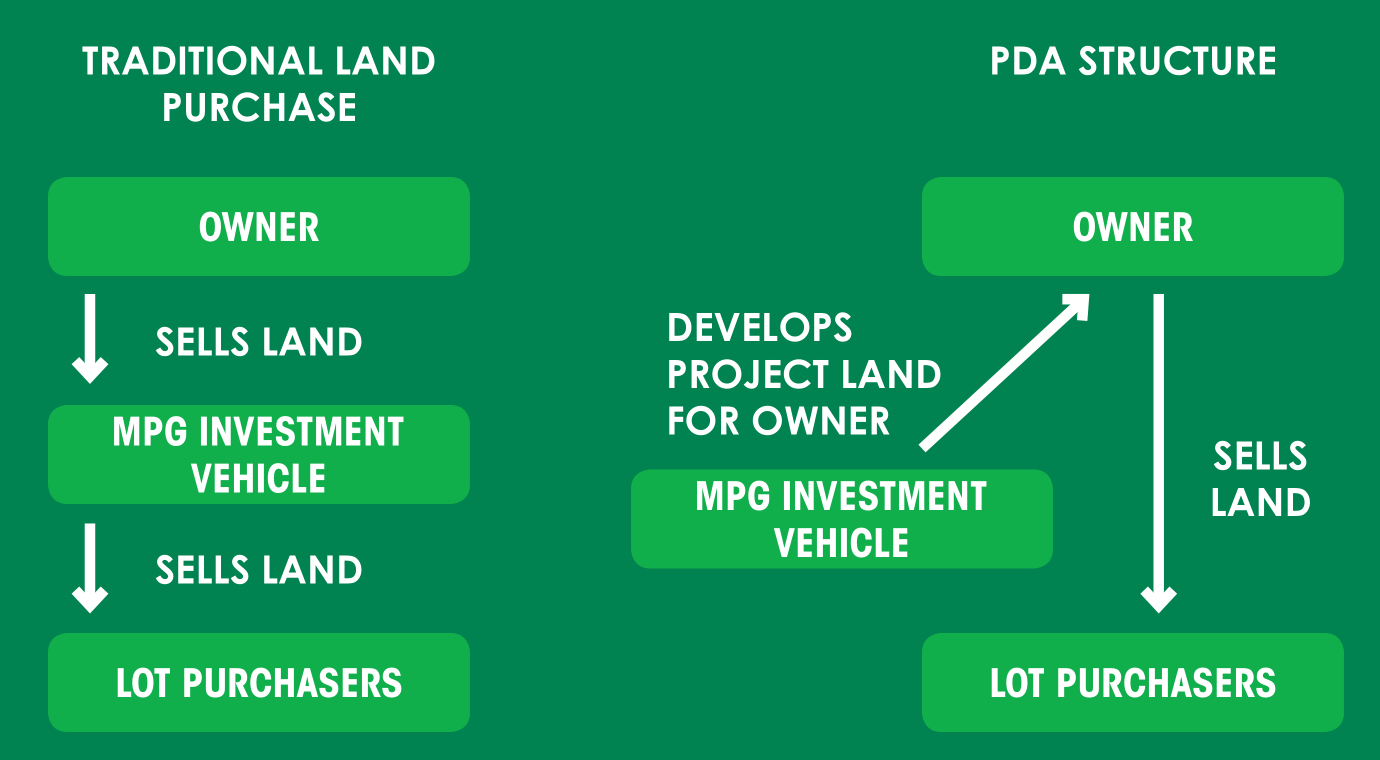

Project Structure

- MPG negotiates Project Development Agreements (PDA) with Land owners rather than an outright purchase of the Project Land.

- A PDA is an agreement under which the land stays in the name of the Owner but gives full control of the development to the investment vehicle.

- The investment vehicle develops the Project Land under a management agreement with MPG and sells the completed land allotments on behalf of the Owner.

- Subject to negotiation, there may be an opportunity for a nominee of an investor to be employed by the investment vehicle on a full or part time basis.

PDA Benefits

This structure provides several key benefits:

- Significantly less capital required;

- Land is used as security to fund the Project;

- No acquisition fees such as legal or stamp duty (a transfer tax of up to 5.5% of the purchase price of land); and

- Dramatically reduces Government taxes such as land tax and council rates based on the increased land value resulting from rezoning.

Comparison Chart

Project Funding

The Project is funded by:

- Land Owner

- Investors

- Bank

Land Owner Funding

MPG negotiates a PDA with the Land Owner under which a “purchase price” (Minimum Return) is agreed at bank valuation or below. The Minimum Return is an “all up” sum which is interest free

- The Owner is paid part of the Minimum Return “up front” on signing the PDA;

- The remainder of the Minimum Return is paid from Lot sales on completion of the Project.

Investor Funding

Investors lend funds to the investment vehicle:

- To make the initial upfront payment to the Land Owner;

- To meet Australian Bank Funding Equity requirements; and

- Pay “soft” Project costs not covered by Bank funding.

Investor Loan Terms:

- 10% interest accruing and paid on completion of the Project; and

- Initially secured by a 1st Mortgage over the Project Land becoming a 2nd Mortgage after bank funding is obtained.

Bank Funding

- MPG arranges Bank finance to complete the Project at the

best available Australian Bank Rates. - The Bank will take a 1st Mortgage to secure it’s loans.

Follow us